Ken McElroy – Real Estate Investing Master Course Overview

The Real Estate Investing Master Course by Ken McElroy is designed for aspiring investors at all levels. Whether you wish to write your own deals, learn to syndicate, or become a passive investor, this course provides the essential tools and knowledge to succeed in the real estate market.

Course Objectives

Participants will acquire a comprehensive understanding of various aspects of real estate investing, including:

- Getting Started: Learn the foundational steps to embark on your investing journey.

- Team Assembly: Discover how to build a skilled team to support your investment endeavors.

- Market Analysis: Identify the right market and submarket for your investment strategy.

- Financial Analysis: Gather critical numbers and information to ensure a deal is cash flow positive.

- Offer Writing: Master the art of writing compelling offers to secure deals.

- Due Diligence: Focus on key elements during the due diligence process to mitigate risks.

- Business Planning: Create a comprehensive business plan tailored to your investment goals.

- Investment Management: Learn effective strategies for managing your investment portfolio.

Course Features

The course is structured to be self-guided, allowing participants to learn at their own pace. Key features include:

- Workbooks: Interactive worksheets that facilitate practical learning and application of concepts.

- Real-Life Examples: Case studies and examples that provide insights into successful investment strategies.

- Comprehensive Modules: Organized content covering all aspects of real estate investing.

Detailed Learning Outcomes

- Getting Started in Real Estate Investing

- Understand the fundamentals of real estate investing.

- Learn how to set realistic goals and expectations.

- Assembling Your All-Star Team

- Identify key professionals to include in your team, such as:

- Real estate agents

- Mortgage brokers

- Attorneys

- Property managers

- Understand the roles and responsibilities of each team member.

- Identify key professionals to include in your team, such as:

- Market and Submarket Identification

- Analyze economic indicators and trends to select the most promising markets.

- Use demographic data to identify suitable submarkets for investment.

- Financial Analysis for Cash Flow

- Learn to calculate cash flow, ROI, and other key financial metrics.

- Understand how to evaluate potential deals using detailed financial analysis.

- Writing Offers and Securing Deals

- Gain insights into effective negotiation strategies.

- Understand the components of a strong offer and how to present it.

- Conducting Due Diligence

- Learn what to look for during property inspections and evaluations.

- Understand the importance of environmental assessments and financial reviews.

- Creating a Business Plan

- Develop a tailored business plan that outlines your investment strategy.

- Include financial projections, marketing strategies, and operational plans.

- Investment Management Strategies

- Discover best practices for managing properties effectively.

- Learn how to handle tenant relations, maintenance issues, and financial reporting.

Conclusion

The Real Estate Investing Master Course offers a robust framework for anyone serious about delving into real estate investing. With a focus on practical knowledge and real-world applications, this course empowers you to not only make informed investment decisions but also to thrive in the competitive real estate market. Whether you’re looking to become an active investor or prefer a passive approach, Ken McElroy’s teachings will guide you on your journey to success.

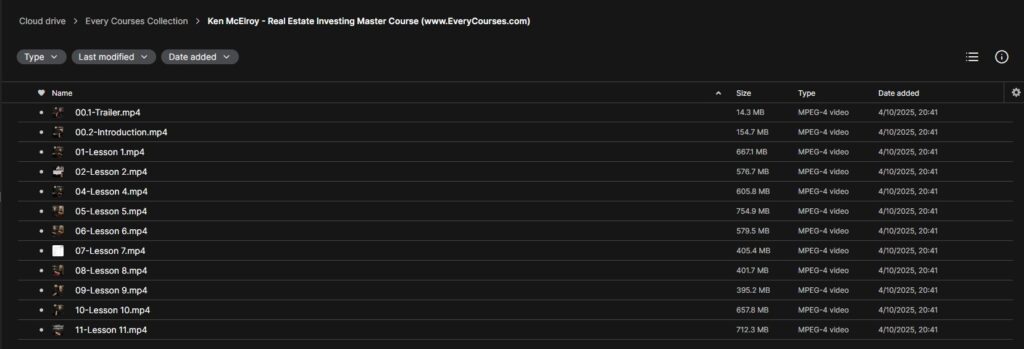

Download Proof (5.79 GB)