Overview of the Codie Sanchez – Main Street Accelerator Course

The Codie Sanchez – Main Street Accelerator course is designed for aspiring acquisition entrepreneurs seeking to buy and run a business. This comprehensive program covers everything from foundational principles to the intricacies of closing a deal. Below is a detailed breakdown of the course units and what they offer.

Unit 1: Foundation

In this unit, participants will learn the essential mindset and foundational knowledge necessary for successful business acquisition.

- Why Acquisition Entrepreneurship?

- The 10 Acquisition Entrepreneur Mindset Pillars

- The Deal Journey & Lifecycle

- Self-Assessment: Do you have what it takes to run a business?

- Resources:

- Action Steps Checklist

- Acquisition Journey Reference Sheet

- Acquisition Self-Reflection Worksheet

Unit 2: Deal Clarity

This unit helps participants refine their personal acquisition criteria using the Contrarian Deal Clarity Framework.

- Understanding Your Motivation: Get clarity on why you want to own a business.

- Business Characteristics: Identify the traits of the business you should buy.

- Target Industries: Discover which industries align with your goals.

- Create Your Own Deal Box: Find your ideal business.

- Resources:

- Zone of Genius Worksheet

- Deal Clarity Worksheet

- Industries Database Selector

- Personalized Deal Box

Unit 3: Origination

Learn effective techniques for sourcing on-market and off-market deals that fit your criteria.

- Deal Sourcing: Understand how to find businesses to buy.

- Marketplaces: Finding deals through platforms like BizBuySell.

- Off-Market Deals: Explore 7 methods for finding off-market opportunities.

- Tracking Progress: How to monitor your business buying progress.

- Resources:

- Business Sourcing List

- Business Broker List

- Deal Sourcing CRM

Unit 4: Outreach

Master the art of presenting yourself as a qualified buyer and building relationships with sellers.

- Positioning Yourself: How to present yourself as a credible buyer.

- Engaging Sellers: Includes effective scripts and the FROG Method for meetings.

- Responding to On-Market Deals: Strategies to get responses.

- Bonus: 3 methodologies for seller outreach.

- Resources:

- Buyer Profile PDF

- Cold Email Outreach Scripts

- Questions to Ask Sellers

Unit 5: Evaluation

Learn to assess potential deals, including signing NDAs and evaluating valuations.

- Valuation Assessment: How to evaluate before making an offer.

- Methods for Valuation: Two techniques for assessing business value.

- SDE Calculation: Learn how to calculate Seller’s Discretionary Earnings.

- Frameworks: The 10 Contrarian Business Value Markers Framework.

- Resources:

- NDA Template

- Deal Decision Tree

- Contrarian Deal Navigator

- Deal Calculator

Unit 6: Offer & Negotiation

Understand the distinctions between various agreements and develop negotiation skills.

- Professional Involvement: Learn when to use professionals at the offer stage.

- LOI vs. APA: What to include in your Letter of Intent (LOI).

- Negotiation Techniques: How to present your offer and handle counteroffers.

- Resources:

- Offer Checklist

- LOI Templates (advanced and simple)

- Asset Purchase Agreement Template

Unit 7: Due Diligence

Navigate the due diligence process and build a capable deal team.

- Performing Due Diligence: How to conduct thorough evaluations.

- Building Your Team: Assemble a team to verify due diligence.

- Key Information: What to look for during this crucial stage.

- Resources:

- 60+ Item Due Diligence Checklist

Unit 8: Financing

Explore various funding methods and acquisition financing strategies.

- Financing Options: Learn the main ways deals are financed, including seller financing, SBA loans, and sweat equity.

- Debt & Equity: Strategies for leveraging both.

- Resources:

- 21 Financing Options Sheet

- Seller Financing Avatar Checklist

Unit 9: Closing

Master the closing process, including legal documentation and escrow.

- Closing Process: Understand how the closing process works.

- Key Players: Identify who is involved in the closing.

- Resources:

- Closing Checklist

Unit 10: Day Zero

Prepare for the transition to ownership and set the stage for success.

- First Day Preparation: Essential tasks to complete on Day Zero.

- Resources:

- Day Zero Checklist

- Working Capital Needs

This course is a comprehensive guide for anyone serious about acquisition entrepreneurship, offering valuable insights, practical resources, and frameworks to ensure a successful business acquisition journey.

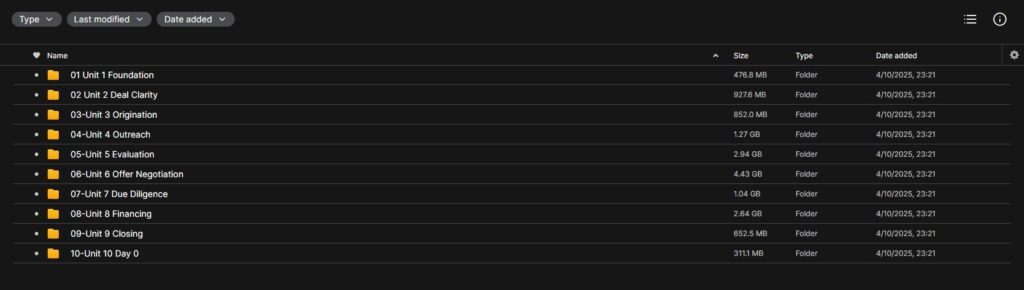

Download Proof (15.47 GB)