Course Overview: No BS Day Trading – Intermediate Course

The No BS Day Trading – Intermediate Course is designed for traders who have a foundational understanding of day trading and are looking to elevate their skills. This advanced instructional course focuses on practical application and real-time examples, providing participants with a deep dive into effective trading methodologies.

Course Content

This course includes seven detailed trades that illustrate various trading setups. Each trade is an opportunity to understand the rationale behind entering and exiting positions, emphasizing the importance of reading order flow for long-term success.

Key Components of the Course:

- Sample Trades:

- Trades are drawn from several webinars, showcasing real-time applications of strategies discussed in the accompanying book.

- Each trade serves as a model for understanding market behavior and decision-making.

- Detailed Explanations:

- Participants receive comprehensive insights into the thought process behind each trade.

- Emphasis on the significance of trade size and its impact on overall performance.

- Variety of Setups:

- Breakouts: Strategies for capitalizing on price movements beyond established resistance or support levels.

- Reversals: Techniques for identifying potential trend reversals and executing trades accordingly.

- Price Action Reads: Understanding market sentiment through price movement in the middle of ranges, enabling strategic positioning.

- Cumulative Volume Profile: Utilizing volume data to gauge market activity and inform trading decisions.

- Smackdown Setup: An advanced strategy outlined in the No BS ebook, focusing on precise entry points during volatile market conditions.

Supporting Documentation

In addition to the video content, the course provides extensive documentation to reinforce learning and application of key concepts.

Key Topics Covered:

- Choosing the Right Treasury Market:

- Guidance on selecting which treasury market to trade based on current market conditions and personal trading style.

- Understanding Drawdowns:

- In-depth discussion on what drawdowns are and strategies for managing them effectively.

- Psychological aspects of dealing with losses and maintaining a disciplined approach to trading.

- Sizing Strategies:

- Criteria for determining when to increase or decrease position size.

- Methods for calculating how many contracts to add or subtract based on market signals and personal risk tolerance.

Conclusion

The No BS Day Trading – Intermediate Course is an essential resource for traders looking to refine their skills and enhance their trading strategies. Through real-world examples and thorough explanations, participants will gain invaluable insights into the nuances of day trading.

This course not only equips traders with the tools necessary for identifying and executing profitable trades but also fosters a deeper understanding of market dynamics and personal risk management. By the end of the course, participants will be better prepared to navigate the complexities of day trading with confidence and competence.

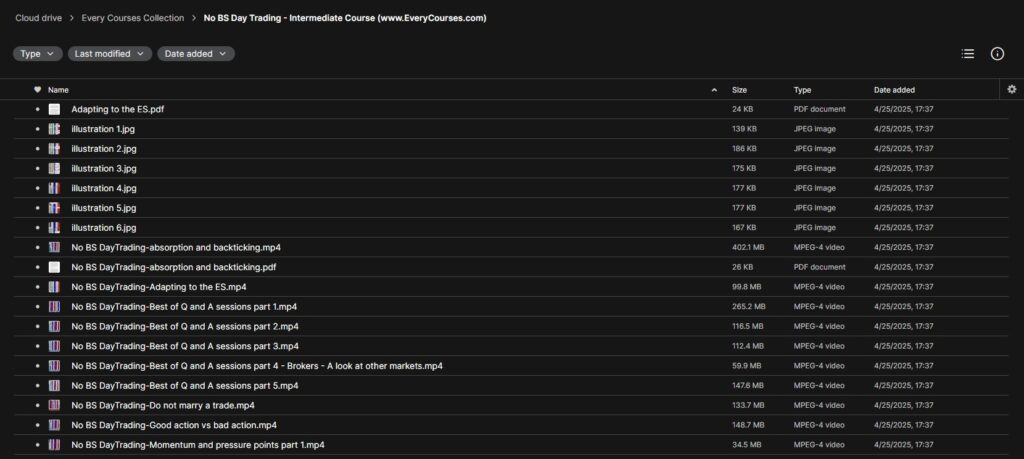

Download Proof (1.82 GB)