Course Overview : Cammy Capital – Volume Profile Trading Course

The Cammy Capital – Volume Profile Trading course is a specialized trading program designed to help traders understand market structure through volume-based analysis rather than traditional indicators. This course focuses on teaching how institutional activity leaves footprints in the market and how traders can use Volume Profile to identify high-probability trading opportunities.

Whether you are a developing trader or someone looking to refine your edge, this course emphasizes clarity, precision, and repeatable execution.

What Is Volume Profile Trading?

Volume Profile is a professional trading tool that shows where trading activity actually takes place, not just price movement. Instead of guessing support and resistance, traders learn to identify:

- High-volume areas where institutions are active

- Low-volume zones where price moves quickly

- True market value and imbalance levels

This course teaches how to use Volume Profile to align trades with smart money behavior.

Core Concepts Covered in the Course

The training breaks down Volume Profile into practical, easy-to-understand components, including:

- Understanding Market Value and Acceptance

- Identifying Point of Control (POC)

- Using High Volume Nodes (HVN) and Low Volume Nodes (LVN)

- Recognizing balanced vs imbalanced markets

- Reading price behavior around volume levels

Each concept is explained with a focus on real-world trading application.

Trading Strategies Using Volume Profile

The course introduces structured strategies built around volume-based levels, helping traders make objective decisions. You will learn how to:

- Identify high-probability entry zones

- Define clear stop-loss and take-profit areas

- Trade range-bound and trending markets

- Use Volume Profile for scalping, day trading, and swing trading

- Combine Volume Profile with price action for confirmation

These strategies aim to reduce emotional trading and increase consistency.

Practical Market Application

A strong emphasis is placed on applying Volume Profile in live market conditions. The course helps traders understand:

- How price reacts when it revisits high-volume areas

- Why price accelerates through low-volume zones

- How institutions defend or abandon value levels

- When to stay out of low-quality setups

This practical approach allows traders to read the market with confidence instead of relying on indicators alone.

Who This Course Is For

Cammy Capital – Volume Profile Trading is suitable for:

- Beginner traders seeking a strong foundation

- Intermediate traders looking to improve accuracy

- Traders struggling with entries and exits

- Anyone interested in institutional-style market analysis

No advanced math or complex indicators are required.

Key Benefits of the Course

- Clear, rules-based trading framework

- Institutional-level market insights

- Reduced guesswork and emotional decisions

- Applicable across multiple markets and timeframes

- Focus on consistency and risk management

Final Thoughts

The Cammy Capital – Volume Profile Trading course offers a professional approach to understanding how markets truly operate. By focusing on volume rather than lagging indicators, traders gain a deeper insight into market behavior and develop a more disciplined and confident trading mindset.

This course is ideal for traders who want a clean, data-driven edge built on real market participation rather than speculation.

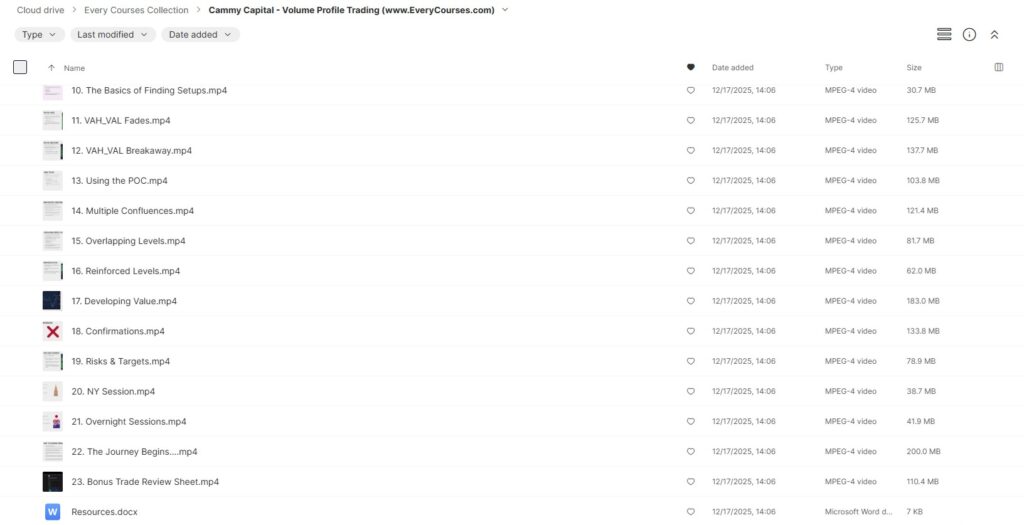

Download Proof (2.73 GB)