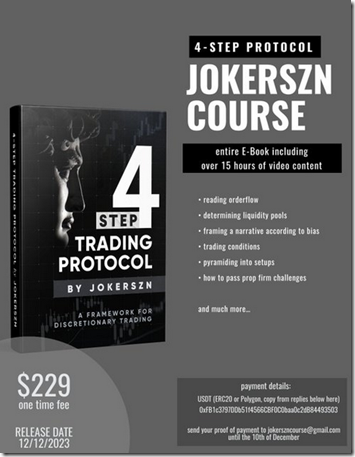

JokerSZN – 4 Step Trading Protocol

The 4 Step Trading Protocol by JokerSZN is a comprehensive trading course designed for traders at all levels who want to enhance their trading strategies and improve their market understanding. This course emphasizes a systematic approach to trading that combines technical analysis with market psychology, providing participants with the tools they need to make informed trading decisions. In this article, we will explore the key components of the course, its structure, and the skills you will acquire.

Course Overview

The 4 Step Trading Protocol is structured around four main steps that guide traders through the essential aspects of successful trading. Each step is designed to build upon the previous one, ensuring a cohesive learning experience.

Key Components of the Course

1. Reading Order Flow

- Understanding Market Dynamics: This module teaches traders how to read order flow, providing insights into market movements and trader behavior.

- Identifying Buyer and Seller Activity: Learn to analyze real-time data to determine where buying and selling pressures exist.

- Making Informed Decisions: Use order flow analysis to anticipate potential market reversals and continuations.

2. Determining Liquidity Pools

- Understanding Liquidity Pools: This section focuses on identifying areas in the market where liquidity is concentrated, which can be pivotal for making trading decisions.

- Locating Key Levels: Participants will learn to spot liquidity pools that can serve as potential entry and exit points.

- Exploiting Market Inefficiencies: Understand how to leverage liquidity pools to your advantage, increasing the likelihood of successful trades.

3. Framing a Narrative According to Bias

- Developing a Trading Narrative: This module emphasizes the importance of framing a narrative based on market bias, helping traders align their strategies with market sentiment.

- Analyzing Market Sentiment: Learn how to assess whether the market is bullish or bearish and adjust your trading plan accordingly.

- Creating a Cohesive Strategy: Use your narrative to inform your trading decisions, ensuring that your actions are consistent with your market outlook.

4. Trading Conditions

- Assessing Market Conditions: This section covers how to evaluate current market conditions and adjust your trading strategies accordingly.

- Identifying Volatility and Trends: Learn to recognize when to trade based on market volatility and prevailing trends, maximizing your chances of success.

- Adapting to Changing Environments: Gain skills to quickly adapt to shifting market conditions, ensuring you remain agile in your trading approach.

Advanced Techniques

In addition to the four foundational steps, the course also covers several advanced trading techniques, including:

- Pyramiding Into Setups:

-

- Scaling Your Positions: Learn how to add to winning positions through pyramiding, enhancing profitability while managing risk.

- Strategic Entry Points: Understand when and how to pyramid effectively to capitalize on market movements.

- How to Pass Prop Firm Challenges:

-

- Navigating Prop Firm Requirements: Gain insights into the strategies and tactics that can help you successfully pass prop firm challenges.

- Risk Management Techniques: Learn essential risk management strategies that will keep your trading account safe while meeting the challenges’ criteria.

Additional Benefits

- Comprehensive Learning Materials: The course includes a variety of resources such as video tutorials, live trading sessions, and access to a community of fellow traders.

- Real-World Applications: Participants will engage in practical exercises that apply the concepts learned in real trading scenarios.

- Expert Guidance: Benefit from the expertise of seasoned traders who share their insights and personal experiences throughout the course.

Conclusion

The 4 Step Trading Protocol by JokerSZN is an invaluable resource for anyone looking to elevate their trading skills and achieve consistent success in the markets. By mastering order flow, liquidity pools, narrative framing, and trading conditions, participants will develop a well-rounded approach to trading that can adapt to various market environments. With advanced techniques like pyramiding and prop firm strategies, this course equips traders with the tools they need to navigate the complexities of the trading world effectively. Embrace the opportunity to transform your trading journey and unlock your full potential as a trader!

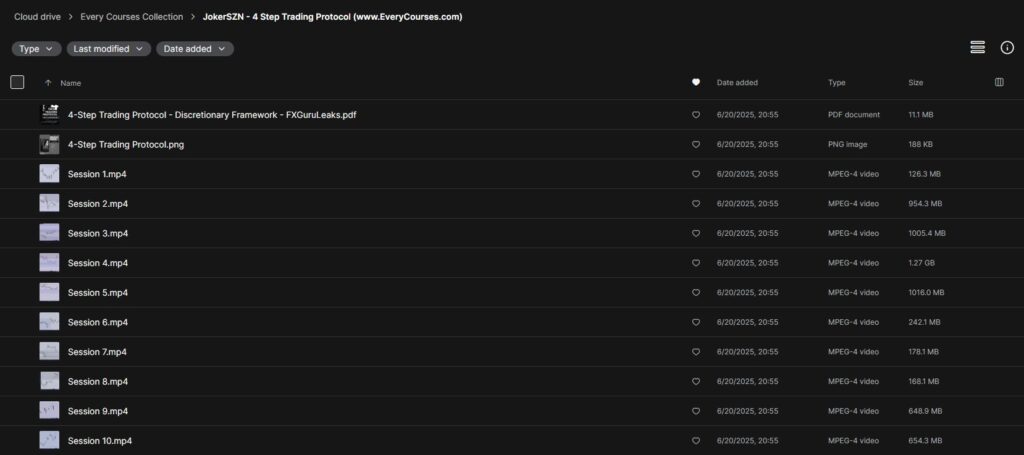

Download Proof (6.15 GB)