Price Action Volume Trader – Day Trading With Volume Profile & Orderflow

Course Overview: Price Action Volume Trader – Day Trading With Volume Profile & Orderflow

The course, Price Action Volume Trader – Day Trading With Volume Profile & Orderflow, is a comprehensive short-term trading strategy designed for traders who want to master intraday market moves using Volume Profile and Orderflow tools. It provides actionable insights into trading in the Futures market and Crypto, with techniques that can also be applied to stocks and currency futures.

What You’ll Learn

This course focuses on leveraging Volume Profile and Orderflow tools to analyze and execute trades effectively on lower timeframes. Here are the key takeaways:

- Short-Term Trading Techniques:

- Learn strategies tailored for shorter-term, intraday trading.

- Capitalize on quick market moves using refined tools and techniques developed over years of futures trading.

- Volume Profile & Orderflow:

- Understand how to utilize Volume Profile in conjunction with Orderflow tools like:

- Delta

- Footprint Charts

- Tick Charts

- Grasp the significance of Volume data and its real-time application in intraday trading.

- Learn to follow Orderflow signals, which provide insights into market activity.

- Understand how to utilize Volume Profile in conjunction with Orderflow tools like:

- Market Focus:

- While the course is primarily focused on Futures, the strategies can also be applied to:

- Stocks

- Currency Futures

- Cryptocurrency markets

- While the course is primarily focused on Futures, the strategies can also be applied to:

Why Volume and Orderflow Matter

- Volume as a Key Indicator:

- Many traders underestimate the importance of volume in trading.

- Volume offers clear and actionable real-time signals, making it indispensable for intraday strategies.

- Orderflow Advantages:

- Orderflow tools give critical insights into the market’s buying and selling activity, providing an edge in identifying market trends and reversals.

Special Features and Bonuses

- Customized Sierra Chart File:

- All students will receive a pre-configured Sierra Charts template used during the course recordings.

- This allows students to start practicing the concepts immediately without needing to set up the tools manually.

- Cross-Platform Applicability:

- The course content is not limited to Sierra Chart. You can use any trading platform that supports:

- Volume Profile

- Tick Data

- Delta

- Footprint Charts

- Market Depth

- The course content is not limited to Sierra Chart. You can use any trading platform that supports:

- Community Support:

- Students gain access to a private Discord community of like-minded traders.

- This allows for ongoing support, idea-sharing, and collaboration with others striving to improve their trading skills.

Who Is This Course For?

This course is ideal for:

- Aspiring and experienced day traders focused on Futures and Cryptocurrency markets.

- Traders looking to transition into short-term intraday trading.

- Those who want to adopt a systematic approach to trading using Volume Profile and Orderflow tools.

- Anyone eager to learn practical, refined techniques directly from a seasoned day trader.

Key Benefits of the Course

- Learn a complete short-term trading strategy that combines Volume Profile with Orderflow tools.

- Gain access to a proven system refined over several years of practical futures trading.

- Explore real-world applications of Volume and Orderflow concepts in multiple markets.

- Benefit from hands-on tools and community support to accelerate your learning.

Why Take This Course?

- If you’re looking for a structured way to learn intraday trading using data-driven tools, this course provides an excellent foundation.

- The practical insights and strategies will help you trade efficiently on lower timeframes and adapt to fast-moving markets.

- With the added advantage of a customized Sierra Chart file and supportive community, you’ll have everything you need to start mastering Volume Profile and Orderflow-based trading. By the end of this course, you’ll have the confidence and skills to navigate the complexities of short-term trading, understand market activity through Orderflow, and make informed trading decisions in real time.

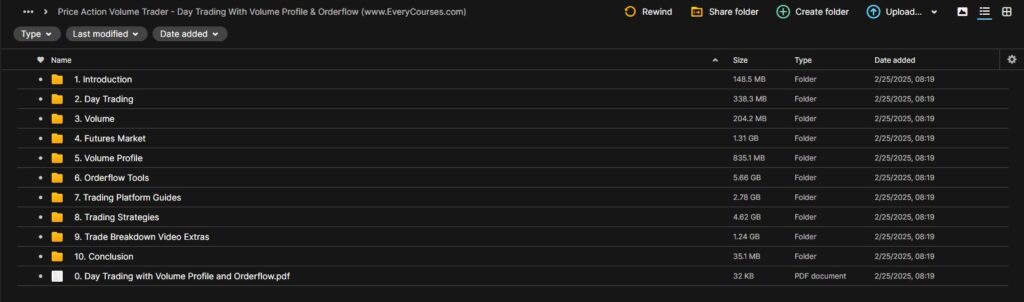

Download Proof (17.13 GB)